The unexpected reason behind the unexpected rise of tokenisation in Japan

- May 11, 2024

- 23 min read

Japan has become a market leader in security token issuance. The secrets of its rise lie in the rapid legal and regulatory reaction to a major cryptocurrency debacle ten years ago; in a characteristically Japanese capacity for collaboration across the boundary that separates the private and the public; in the willingness of major financial institutions to cooperate in building a tokenisation infrastructure; and in a marked preference for getting issues done rather than lapsing into time-consuming and resource-hungry Proofs of Concept and Pilot Tests that never go into production.

Japan was an early host of cryptocurrency trading. So much so that the first big cryptocurrency exchange to fail, a former trading card website called Mt. Gox, was based in Tokyo. By the time it filed for bankruptcy in February 2014 Mt. Gox was reputed to be handling more than two out of three Bitcoin transactions, despite the reputational awkwardness of having been the target of hackers from the beginning of its activities three years earlier.

The regulatory consequences of Mt Gox

The collapse proved seminal. It prompted the Japanese market authorities to establish a coherent regulatory framework for tokenised digital assets of all kinds, including security tokens, much earlier than other major jurisdictions.

Importantly, the authorities chose to build this framework not through the passage of omnibus legislation but via successive amendments to the existing Payment Services Act of 2009 (PSA) and the Financial Instruments and Exchange Act of 1948 (FIEA) (see the Sidebar, “The Regulatory Framework for Security and Fund Tokens in Japan”).

The Regulatory Framework for Security and Fund Tokens in Japan

The Payment Services Act (PSA) 2009

So-called “crypto-assets” - essentially, cryptocurrencies and the “utility” tokens associated with the Initial Coin Offering (ICO) boom of 2017-18 - were regulated under the Payment Services Act (PSA) from April 2017.

Since then, issuing tokens, running a token exchange, providing custody services for tokens or acting as an intermediary for tokens has necessitated registration as a provider of Crypto Asset Exchange Services (CAES) with the Financial Services Agency (FSA).

There are a pair of curious omissions from this otherwise comprehensive regime. Non-Fungible Tokens (NFTs) are not regulated as financial assets and nor is the staking or lending of “crypto-assets” in order to generate an income from holdings of cryptocurrencies.

Stablecoins are also regulated under the PSA via the Amendment for the Purpose of Establishing a Stable and Efficient Funds Settlement System (which was agreed in June 2022, came into force in June 2023, and permits issues from June 2024).

The Amendment established a regulatory regime for Stablecoins issued internationally as well as domestically. Those backed by fiat currency are treated as “Electronic Payments Instruments (EPIs)” under the PSA, while those backed by “crypto-assets” are subject to the “crypto-assets” regulation. The primary objective is to favour EPIs issued by Electronic Payment Instruments Intermediaries (EPII) – namely, banks – that must register.

The Financial Instruments and Exchanges Act (FIEA) 1948

The Financial Instruments and Exchange Act (FIEA) of 1948 was long the principal law governing the regulation of securities in Japan and, as amended in May 2020, its scope now includes tokenised securities representing bonds, shares, funds and derivatives. The law somewhat clumsily characterises all these asset classes as “Electronically recorded transferable rights (ERTRs).”

Essentially, ERTRs are regulated in a fashion like traditional securities. But there are some important differences.

The regulation of traditional securities under FIEA distinguished between “Paragraph 1” financial assets (tradeable and liquid instruments such as shares, bonds and exchange-traded derivatives) and “Paragraph 2” financial assets (less tradeable and less liquid contractual rights, such as interests in investment trusts and collective investment schemes such as mutual funds).

“Paragraph 1” securities can be handled by Type I Financial Instruments Business Operators only – namely, securities companies such as Daiwa Securities and Nomura Securities. “Paragraph 2” securities, on the other hand, can be handled by Type 2 Financial Instruments Business Operators - typically, asset managers which must register with the FSA, but otherwise face less onerous requirements.

Where do ERTRs fit within this binary system? In theory, ERTRs can be issued as either “Paragraph 1” instruments (say, bonds) or “Paragraph 2” instruments (say funds). This presented the framers of the law with a dilemma. Tokens that might have been classified as “Paragraph 2” instruments in the past would be sufficiently liquid to be classified as “Paragraph 1” instruments today. A tokenised fund, for example, can be tradeable on a secondary market, unlike a conventional mutual fund, which can be purchased and redeemed by the issuer only.

The dilemma was resolved by subjecting ERTRs that would have ranked as “Paragraph 2” instruments under the old regime to the “Paragraph 1” regulatory regime. In other words, it is not just security tokens that are subject to a more rigorous regulatory regime, but fund tokens as well.

The Act on Engagement in Trust Business by Financial Institutions 1943

The custody of tokens entails both safekeeping (the storage and management of private keys) and transfer and registration (the execution of transfers of tokens and claims of beneficial ownership upon purchase or sale of tokens).

According to MUFG, which already acts as a custodian to a number of security token issues in Japan, both custody functions can be carried out safely by the same trust banks that have dominated custody in Japan since the passage of the Act on Engagement in Trust Business Activities by Financial Institutions of 1943. The regulators have vet to disagree.

The first fruits of Mt. Gox were an investigation by the Japanese Financial System Council, which set up a study group in late 2014 that evolved into a Working Group to consider what regulatory changes should be made in the wake of the debacle.

The final report of the Working Group in December 2015 emphasised the need to protect investors in cryptocurrencies, not least through segregation of assets and capital requirements. It also led to legislation in 2016 to extend the Financial Action Task Force (FATF) Anti Money Laundering (AML) recommendations to cryptocurrencies, though this is of course something Japan undertook not in response to Mt. Gox but as a supporter of the FATF recommendations. (1)

In May 2020 Japan also became the first country to regulate the emerging token markets when legislative changes proposed by the Japanese banking, securities and insurance regulator, the Financial Services Agency (FSA), were implemented by the government through amendments to the FIEA. These came into effect in May 2021.

The new measures widened the regulatory perimeter beyond cryptocurrencies to encompass “crypto-assets” and “crypto-asset” derivatives and, in line with the Working Group recommendations of December 2015, required third party custody of customer funds, and 100 per cent asset backing if the assets were held in “hot” digital wallets accessible via the Internet. (2) The May 2020 changes also required “crypto-asset” exchanges and service providers to register with the FSA.

In June 2022 Japan scored yet another first when it pioneered implementation of the global regulatory consensus on Stablecoins. The measures taken by the Japanese government effectively restricted Stablecoin issuance to banks and required Stablecoins issued outside Japan to be backed by assets in custody in Japan, which is a substantial constraint on an adventurous approach to Stablecoin collateral management. The new measures also brought digital asset custodians (as holders of the assets that underpin Stablecoins) within the scope of regulation for the first time. (3)

Between them, these successive steps - addressing cryptocurrencies, then tokens and finally Stablecoins - have imparted a degree of confidence to Japanese market participants. They have also moved the country not just beyond cryptocurrencies but beyond the seemingly endless stream of Proofs of Concept and Pilot Tests that have stymied progress in Europe in particular. In fact, Japan has become one of the most active security token jurisdictions in the world.

Collaboration is the key to progress in Japan

In fact, Japan is so active that tokenised issues are already a major force in the domestic capital markets. In 2023 the Japan Exchange Group (JPX) reported that approximately JP¥ 588.7 billion of new conventional securities were issued in Japan46. Future of Finance estimates that new token issues in 2023 were worth JP¥ 114.2 billion, a figure equivalent to 19.4 per cent of the value of conventional issues. This is a huge share of the total market for a new instrument that was unknown in the Japanese market before 2021.

Characteristically, the relatively rapid progress in security token issuance in Japan has relied on a considerable degree of cooperation between the government, the regulators and the major financial institutions.

Indeed, in addition to amending the PSA and the FIEA to provide a stable legal framework for tokenisation, the Japanese authorities have endorsed a pair of self-regulatory organisations (SROs) that they expect to contribute to the safety and integrity of the token markets.

The Japan Virtual Currency Exchange Association (JVCEA) SRO was set up in 2018 to monitor the cryptocurrency industry in Japan. The Japan Security Token Offering Association (JSTOA) SRO followed in October 2019 as the security token equivalent of the JVCEA.

JSTOA (not to be confused with the Japan Securities Token Association (JSTA), which is a trade association dedicated to the promotion of security tokens (4)) has been formally recognised by the FSA and has broad responsibility for setting the day-to-day rules by which securities tokens are managed.

Between major financial institutions, collaboration is equally extensive. The largest and longest established Japanese banks and securities houses - such as Mitsubishi UFJ Financial Group (MUFG) and Daiwa and Nomura – have risen to the challenge issued by the amendments to the PSA and the FIEA for regulated firms to take responsibility for what happens in the token markets.

This does not mean the Japanese environment is hostile to innovators. A relative newcomer, SBI Securities, the securities arm of SBI Holdings, has been welcomed too, and become a major distributor of security tokens (see Chart 3, page 70). The firm has helped to distribute at least eight token issues worth a total of JP¥ 23.7 billion.

Collaboration clearly works. Although the number of identifiable issues is still low (see Chart 1), and the total sum raised is not high (JP¥ 155.13 billion, or about US$1 billion) Japan has almost certainly (the lack of comprehensive data for Japan, and of comparative data for other jurisdictions, makes it hard to know for sure) hosted more security token issues than any other jurisdiction.

Chart 1

The asset classes that are being tokenised

Issuance was at first driven overwhelmingly by tokenised real estate vehicles and real estate projects seeking retail investors. Real estate continues to be the major source of activity, accounting for more than two thirds of issues (see Chart 2).

This matches tokenisation experience in the United States and elsewhere. Real estate

has emerged as a tokenisable asset because it is intrinsically illiquid, lacks an operational infrastructure to turn it into securities as opposed to funds, and appeals to wealth managers looking to diversify client portfolios into an asset class with unattainably high minimum subscriptions.

Also in common with tokenisation experiences elsewhere, and especially in Europe, bonds are the second most common asset class to be tokenised in Japan. They were among the earliest security token issues (SBI Securities issued the first tokenised bond in Japan in April 2021).

Again in common with other jurisdictions, green bonds were identified comparatively early as a natural target for tokenisation in Japan. The ability of tokens to share project tracking information (the research arm of the Japan Exchange issued a green tracking bond in June 2022) is the obvious attraction.

But the flagship tokenised bond issues in Japan are those by the multinational conglomerate and household name Hitachi in December 2023 (JP¥ 10.0 billion of “digitally tracked” green bonds) and March 2024 (JP¥ 10.0 billion of five year straight green bonds) (see Sidebar “Security Token Issues in Japan Since the FIEA Law Changed in May 2020”).

Chart 2

Secondary market activity has yet to develop

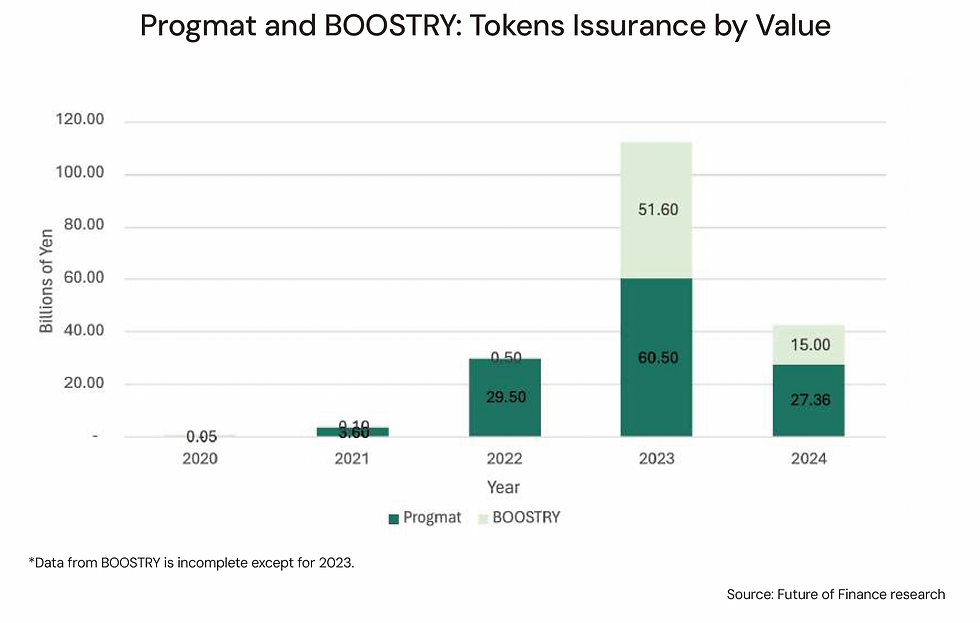

Issuance of security token issues is dominated by two tokenisation platforms: Progmat and BOOSTRY. Each was founded by a single major financial institution but both – in keeping with the Japanese penchant for collaboration – are now owned by a consortium (see Sidebars “Progmat, Inc.” and “BOOSTRY”).

Progmat, which appears to be the largest of the two – it publishes details of issues it has supported on its website, which BOOSTRY does not do - has so far supported 23 issues worth a total of JP¥ 120.96 billion (see Sidebar “Security Token Issues in Japan Since the FIEA Law Changed in May 2020”).

Research by Future of Finance has identified only four issues supported by BOOSTRY for a total value of JP¥ 10.65 billion – implying an average issue value about half the size (JP¥ 2.66 billion) of the issues supported by Progmat (JP¥ 5.26 billion). This probably under-estimates activity on BOOSTRY.

Importantly, neither Progmat nor BOOSTRY is a trading platform or exchange. In fact, trading and the liquidity it can bring to token markets has yet to develop in Japan, despite the relatively high level of issuance activity.

So far, the country has only one dedicated security token market. The Osaka Digital Exchange (ODX), which has operated as a conventional market since 2022, went live with its START Securities Token market on Christmas Day 2023. At present the market lists just two security tokens (both backed by real estate assets) and modest volumes of activity.

Like Progmat and BOOSTRY, ODX is also owned by a consortium made up of SBI Holdings (with a 59 per cent stake) plus Sumitomo Mitsui Financial Group, Nomura Holdings, Daiwa Securities Group and CBOE Worldwide Holdings Limited.

However, a second security token exchange is now in prospect. The JPX, whose Market Innovation and Research unit (JPXI) is not only a token bond issuer in its own right but developing data and market indices for the token markets, announced in April 2022 that it will launch a blockchain-based securities token market in April 2025.

JPX launched a green bond issue the same month, sensing longer term opportunities in sustainability issues. The exchange is also an investor in both Progmat and BOOSTRY (see the Sidebars “Progmat Inc.” and “BOOSTRY”).

The established securities houses are the main distributors

As encouraged by the regulators, the securities houses that have dominated security distribution in Japan for decades also own security token distribution. Daiwa Securities has emerged as the market leader (see Chart 3). It has helped to launch security token issues worth JP¥ 80.1 billion.

Relative newcomer SBI Securities ranks second in terms of the number of issues but their collective value (JP¥ 23.7 billion) and average size (JP¥ 2.96 billion) puts it behind the long established Nomura (JP¥ 27 billion at JP¥6.75 billion apiece) and SMBC Nikko Securities (JP¥ 24.5 billion at JP¥ 8.16 billion apiece).

Chart 3

Daiwa Securities has a minority stake in ODX, as does its nearest rival, Nomura Securities. Indeed, the two firms, along with Kabu.com Securities (an arm of Mitsubishi UFJ Securities) and online securities broker Monex, were also founders of the JSTOA.

With 15 full members (all securities firms) and 53 supporting members (a mixture of tokenisation platforms, legal and accounting firms, issuers, security token exchanges and the JSTA), the JSTOA SRO represents the collaborative approach in institutional form.

It can of course be argued that long-established securities firms are bound to endorse a self-regulatory approach. It is harder to dismiss the openness of their approach to the ownership of the two platforms driving tokenisation in Japan.

How the tokenisation platform consortiums were created

Progmat (originally founded by MUFG) and BOOSTRY (founded by Nomura) are the organisations that structure, issue and support security tokens – and both have found it makes sense to open ownership to other market participants.

Progmat and BOOSTRY have adopted wider ownership structures because it became clear that competing firms would not use a platform owned by a major bank or a major securities house alone, since that risked creating a monopolistic or duopolistic market.

Progmat is now owned by eight firms and has independent management. Its Digital Asset Co-Creation Consortium (DCC) has an even wider embrace. The DCC aims to draw in a network of potential issuers in corporate Japan as well as professional advisers such as lawyers and accountants, which are likely to be fruitful sources of issuance activity (see the Sidebar “Progmat Inc.”).

Both Progmat and BOOSTRY have found it makes good commercial sense to share ownership of their tokenisation platforms with other market participants because it encourages them to make use of their services.

Progmat, Inc.

Progmat, Inc was founded in 2021 as a wholly owned subsidiary of Mitsubishi UFJ Trust and Banking Corporation (MUFJ). It hosted both security tokens (a total of JP¥ 120.96 billion through March 2024) and utility tokens under that parentship until September 2023, when ownership was opened to a wider group.

Although MUFJ retains the biggest stake, Progmat is now owned by another seven institutions that include two other powerful banking groups (Mizuho and Sumitomo Mitsui) as well as telecommunications giant NTT and SBI Holdings.

So the platform has a broad and influential set of owners – and the board structure indicates a high degree of cooperation between them.

Progmat has done most of its business with securities tokens but is active also in the utility token market. Utility tokens are well-established in Japan and Progmat views them as a long-term growth area, mainly through links to customer loyalty or rewards programmes. In September 2022, for example, Japanese retailer Marui issued bonds to its card holders (see the Sidebar “Security Token Issues in Japan Since the FIEA Law Changed in May 2020”).

Initially, Progmat saw links between security and utility tokens. It expected security tokens to be issued with utility tokens attached. This actually happened in a number of early issues, where investors gained access to free coffees from hospitality companies and room upgrades from hoteliers, but this aspect has disappeared as security tokens have become better established.

Progmat is also looking at the potential to issue Stablecoins. The PSA Act amendment passed in June 2023 allows the introduction of these from June 2024. Though obviously none are issued yet, it is clear that Progmat is interested in acting as a platform for the issuance of Stablecoins that conform to Japanese regulatory requirements.

In the longer term, Progmat is pursuing an expansive and ambitious strategy (“Connecting society with programmable networks to digitise every possible form of value”) that rests on a conviction that all forms of assets will one day be tokenised.

In pursuit of this, Progmat has created a broad coalition of interests via the Digital Asset Co-Creation Consortium (DCC), which currently has 254 members. That is enough to encompass a large swathe of corporate Japan, a lot of financial institutions and a list of technology companies, law and accountancy firms, and FinTechs, including cryptocurrency companies.

BOOSTRY has also admitted shareholders other than Nomura and is now independently managed in a fashion similar to Progmat (see the Sidebar “BOOSTRY”) and has followed a similar path, but with a larger vision of what openness can deliver.

BOOSTRY has opened its blockchain platform iBet for Fin – which it founded in April 2021 - to other companies, in the expectation of attracting developers to create apps for issuers and investors, as well as attracting issuers and investors directly.

BOOSTRY

BOOSTRY was established in September 2019 as a joint venture between two affiliates of the Nomura securities house: Nomura Holdings (which owned 66 per cent) and Nomura Research Company (which owned 34 per cent).

The initial goal was a blockchain platform called iBet for Fin that would use the Daml smart contract language offered by Digital Asset (5) to lower the cost of issuing bonds. But the idea soon ran into resistance from other securities firms reluctant to support a platform controlled by a major securities house.

In July 2020 SBI Holdings took a 10 per cent stake in BOOSTRY, and in March 2023 the Japan Exchange Group (JPX) acquired 5 per of the capital, so although Nomura still controls the organisation it has both an establishment shareholder and an entrepreneurial shareholder.

Secondly - and more consequentially - BOOSTRY now offers the iBet for Fin blockchain platform not as a proprietary network but as an independent and open technology whose goal is to simplify and standardise all the elements of the security token lifecycle.

It rests on Quorum, the open source but permissioned blockchain protocol developed initially by J.P. Morgan but acquired in August 2020 by Consensys, the Ethereum-based blockchain company founded by Joe Lubin.

BOOSTRY serves as the secretariat for iBet for Fin and continues to help develop and support the protocol, but other users are free to contribute applications. Other actors in the Japanese token eco-system certainly seem to be comfortable that iBet for Fin is autonomous.

Since it became open in April 2021 with just four member-users, iBet for Fin has added 18 more. They include six securities houses (SBI Securities, LINE Securities, Mizuho Securities, Daiwa Securities and Mitsui & Co., Ltd Digital Asset Management as well as Nomura Securities) and six banks and trust banks (Sumitomo Mitsui Trust Bank, Mizuho Trust Bank, SMBC Trust Bank, Mizuho Bank and Resona Bank as well as Nomura Trust Bank,) as well as exchanges and technology vendors. BOOSTRY expects the member-firms to help attract others to develop applications for use on the iBet for Fin network.

The ibet for Fin platform is currently accessed by 18 separate financial institutions in Japan. It provides the members – mainly securities houses, banks and trust banks - with the ability to issue and service security tokens without investing in proprietary systems, while also enabling developers to script new services for security tokens on the same platform.

The role of asset managers in tokenisation in Japan

However, information on issuance activity hosted by BOOSTRY is less complete than the information provided by Progmat. On its website, Progmat records a total of 23 issues over the four years between 2021 and 2024 (see Sidebar “Security Token Issues in Japan Since the FIEA Law Changed in May 2020”). (6)

Comparable data for these years for BOOSTRY is not available, so Chart 4 is based on publicly available information about four issues between 2020 and 2023 with a total value of JP¥ 10.65 billion, and other information published by BOOSTRY. (7) This data almost certainly under-estimates activity on BOOSTRY in years prior to 2023 and possibly in 2024 as well (see Chart 4).

Chart 4

Despite not being a shareholder, Daiwa is the leading distributor on Progmat, helping to distribute eight issues worth a total of JP¥ 80.1 billion. But securities houses need issuers, and asset managers have proved more fruitful than corporates (see Chart 5). Six of the eight issues led by Daiwa Securities, for example, were issued on behalf of Kenedix Asset Management (KDX).

Chart 5

In fact, KDX is the most active asset manager, with nine issues to its credit so far, valued at JP¥ 86.26 billion (see Chart 5). Kenedix is one of the largest real estate asset management companies in Japan, managing over JP¥ 3 trillion in assets. The company has described security tokens as “the third pillar of our business” after Real Estate Investment Trusts (REITs) and privately managed funds.

Kenedix predicts substantial growth in Japan’s real estate security token market over the next five years. It expects issuance to reach JP¥ 500 billion by 2025 and the real estate tokenisation market to be worth JP¥ 2.5 trillion by 2030. (8)

A fund management arm of Sumitomo Mitsui is also a regular issuer on Progmat, with eight issues worth a total of JP¥ 21.1 billion. The tokens are sold through the Sumitomo Mitsui banking network.

Coupled with issues reported elsewhere, the Sumitomo Mitsui asset management subsidiary is responsible for ten issues worth a total of JP¥ 36 billion - all of them asset-backed by real estate.

The other asset managers involved in security token issuance in Japan are Ichigo Asset Management, Mitsubishi Group Asset Management and Marubeni Asset Management (see Chart 5 and the Sidebar “Security Token Issues in Japan Since the FIEA Law Changed in May 2020”).

The role of the securities houses

If asset managers are the main issuers, the securities houses are responsible for the distribution of the tokens to investors. Daiwa securities is the market leader on Progmat, thanks largely to KDX.

Nomura has no equivalent of KDX to provide a steady stream of new issues. Indeed, it is not that conspicuous even on the BOOSTRY platform it created and continues to dominate as the biggest shareholder (see Chart 3). Two of the four deals involving Nomura that are identified in the Future of Finance database actually used Progmat, not BOOSTRY.

SBI Securities, the brokerage arm of SB Holdings, is actually more active than Nomura in the Japanese token markets, being involved as a distributor in eight deals. Only Daiwa Securities can match that number, but the average size of the issues supported by SBI Securities (JP¥ 23.7 billion) is conspicuously lower than the equivalent figure for Daiwa Securities (JP¥10.01 billion).

Predictably, MUFG, the creator of Progmat, is the preferred custodian to Progmat issues. Likewise, the major banking groups that have issued tokens in their own name tend (unsurprisingly) to reserve for themselves custody of their own issues. And it is Mizuho Bank, not MUFG, that is more prominent in the role of administrator and fiscal agent, whose chief responsibilities are payment of income and ensuring tax compliance.

Nor do Progmat and BOOSTRY have the Japanese tokenisation market to themselves in terms of technology. The California-based tokenisation engine Securitize supported one of the first security token issues in Japan when Sumitomo Mitsui tokenised its credit card receivables.

Securitize technology was also used in the Marui bond issue to cardholders in September 2022 and another transaction in April 2023 when Sumitomo Mitsui led the tokenisation of real estate assets of Sony Bank (the financial arm of Sony Corporation) for sale to clients of Sony Bank (see Sidebar “Security Token Issues in Japan Since the FIEA Law Changed in May 2020”). So Securitize has supported three token issues in Japan.

A domestic technology vendor is also active in the market. HashDasH Holdings, a Japanese firm that sees an opportunity to use tokens to fund sustainable energy and agricultural projects, has joined forces with Tokai Tokyo Securities, the Japanese securities house. Tokai Tokyo has invested in HashDasH and is working with HashDasH and the ADDX digital asset exchange in Singapore to tokenise Japanese real estate for sale to Tokai Tokyo clients.

What are the lessons for other jurisdictions?

Which further confirms that the Japanese business establishment is not shy of committing money and time to tokenisation, and that collaboration comes easily to Japanese companies.

Indeed, it is the participation of traditional, regulated financial institutions – banks, securities houses and asset managers – in a variety of collaborative ventures, and not start-ups, that is driving progress in tokenisation in Japan.

While it is tempting to conclude that the authorities and business are approaching the token opportunity in the same way that the Ministry of International Trade and Industry (MITI) and the keiretsu approached the re-industrialisation opportunity after 1945, that would not do justice to the reactive, pragmatic and flexible nature of developments by both the public and the private sectors since the demise of Mt. Gox.

Besides, not everything that happens in Japan is sui generis. The bias to real estate and bonds in the Japanese token market is apparent elsewhere too. So is the lack of progress in creating secondary as opposed to primary markets, though the ODX START market (already live) and the JPX security token trading platform (scheduled to start in April 2025) show the opportunities and the benefits of secondary market trading are well-understood.

In fact, the principal lesson for other jurisdictions of the Japanese experience

of tokenisation is not the intensity of the collaboration between domestic financial institutions, regulators and policymakers but openness. The presence in the Japanese market of one leading foreign supplier of tokenisation technology (Securitize) is one instance of this. It proves that the country is not closed to outsiders.

But openness is especially true of the two leading tokenisation platforms, both of which have opened themselves to new shareholders and both of which are soliciting business from issuers and investors throughout Japan. One even encourages third party developers to contribute to the development of the platform in a way that echoes the pioneering years of the Internet of the early 1990s. That is the unexpected lesson of tokenisation in Japan: the market is working, not because it is collaborative, but because it is open.

The principal lesson for other jurisdictions of the Japanese experience of tokenisation is not the intensity of the collaboration between domestic financial institutions, regulators and policymakers but openness.

Security Token Issues in Japan Since the FIEA Law Changed in May 2020

2020

October 2020: The first issue under the new law was an equity issue for SBI Holdings subsidiary SBI e-sport, a firm managing esports platforms, for JP¥ 50 million on the iBet for Fin blockchain built by BOOSTRY. SBI, a 10 per cent shareholder in BOOSTRY, underwrote and distributed the tokens to third party investors.

2021

February 2021: Daiwa subsidiary Fintertech issues one month tokenised bonds on behalf of Daiwa Securities (JP¥ 10 million) and Daiwa Food and Agriculture (JP¥ 1 million) to Daiwa Securities Group on Liquid Network as part of trials of the Bitcoin Lightning network sidechain to prove that digital money can be used to pay interest and redeem bonds.

April 2021: Sumitomo Mitsui Trust Bank issued a security token backed by credit card receivables using Securitize tokenisation technology. It was the first security token to receive an investment grade rating (A-1).

April 2021: SBI Securities, the brokerage arm of SBI Holdings, issued a JP¥ 100 million short-term bond on to the BOOSTRY iBet for Fin blockchain, acting as sole underwriter and distributor. An unusual feature was that any buyer of a JP¥ 100,000 denomination bond with an account at the SBI VC Trade cryptocurrency trading arm of SBI Holdings also received 10 XRP, the native token of the XRP Ledger and the cryptocurrency used by the Ripple payment network.

April 2021: Osaka Digital Exchange Co., Ltd was founded by a consortium of SBI Proprietary Trading System (PTS) Holdings (59 per cent), Sumitomo Mitsui Financial Group, Nomura Holdings, Daiwa Securities Group and CBOE Worldwide Holdings Limited. It started trading conventional securities through a PTS and on Christmas Day 2023 opened the START securities token secondary market for trading.

July 2021: A JP¥2.8 billion asset-backed real estate token issue is the first to be offered using the Progmat token issuance and servicing platform built and owned by Mitsubishi UFJ Trust and Banking Corporation (MUFG). The operator was Kenedix Asset Management, a major Japanese real estate fund manager; Nomura Securities acted as distributor and custodian of the physical assets; SBI Securities also acted as a distributor; and MUFG was trustee and custodian of the private keys to the tokens.

November 2021: Progmat hosts the JP¥ 800 million tokenisation of a logistics facility on Rokko Island, operated by Mitsui & Co.’s asset management arm. SBI Securities acted as distributor.

2022

February 2021: Daiwa February 2022: JP¥ 2.1 billion of student accommodation is tokenised through Progmat, operated by Kenedix Asset Management, and distributed by Daiwa Securities and SMBC Nikko Securities.

February 2022: A hot spring facility in Kusatsu is tokenised through Progmat, raising JP¥ 4.2 billion. Mitsui & Co.’s asset management arm acted as operator and Nomura Securities as distributor.

April 2022: Japan Exchange Group (JPX) announces plans to launch a security token market in April 2025.

May 2022: Three residential real estate properties in Tokyo are tokenised through Progmat, raising JP¥ 3.0 billion. Mitsui & Co.’s asset management arm acted as operator and SBI Securities as distributor.

June 2022: JPX Research Institute (part of the JPX group) issues a JP¥ 500 million Green Tracking Bond though the BOOSTRY tokenisation issuance and servicing platform.

July 2022: A logistics facility in Atsugi is tokenised through Progmat with a valuation of JP¥ 15.0 billion. The operator was Kenedix Asset Management, and the distributor was Daiwa Securities.

September 2022: Japanese retailer Marui issued tokenised one-year bonds worth JP¥ 120 million to card holders, using Securitize technology.

November 2022: Three residential real estate properties in Tokyo are tokenised through Progmat, raising JP¥ 5.2 billion. Ichigo Asset Management acted as operator and SBI Securities as distributor

2023

April 2023: A hot spring facility in Sapporo is tokenised through Progmat, raising JP¥ 7.7 billion. The operator was Kenedix Asset Management, and the distributor was Daiwa Securities.

April 2023: Sony Bank agreed with Sumitomo Mitsui Trust Bank to offer tokenised real estate from the Sony Bank portfolio to Sony Bank clients, using tokenisation technology from Securitize.

May 2023: Accommodation in Maihama worth JP¥ 12.9 billion is tokenised through Progmat. The operator was Kenedix Asset Management, and the distributor was Daiwa Securities.

May 2023: Residential real estate in Nihonbashi worth JP¥ 3.1 billion is tokenised through Progmat. Mitsui & Co.’s asset management arm acted as operator and distributor.

May 2023: Residential real estate in Komagome worth JP¥ 2.0 billion is tokenised through Progmat. Marubeni’s asset management arm acted as operator and SBI Securities as distributor.

June 2023: A logistics facility in Tokorozawa worth JP¥ 13.0 billion is tokenised through Progmat. The operator was Kenedix Asset Management, and the distributor was Daiwa Securities.

July 2023: Residential real estate in Tokyo worth JP¥ 6.9 billion is tokenised through Progmat. The operator was the asset management arm of Ichigo and the distributor was SBI Securities.

July 2023: Accommodation in Kyoto/Sanjo worth JP¥ 1.1 billion is tokenised through Progmat. Mitsui & Co.’s asset management arm acted as operator and distributor.

July 2023: Tokai Tokyo tokenises real estate income from properties owned by real estate developer Tosei.

August 2023: Accommodation in Riverside 21 East Towers in Chuo ward in Tokyo valued at JP¥ 30 billion is tokenised by Kenedix Asset Management, raising JP¥ 13.4 billion.

September 2023: Accommodation in Atami worth JP¥ 1.4 billion is tokenised through Progmat. Mitsui & Co.’s asset management arm acted as operator and distributor.

November 2023: Residential real estate in Yokohama worth JP¥ 2.5 billion is tokenised through Progmat. Mitsui & Co.’s asset management arm acted as operator and distributor.

November 2023: Residential real estate in Tokyo worth JP¥ 2.9 billion is tokenised through Progmat. The operator was the asset management arm of Ichigo and the distributor was SBI Securities.

December 2023: Okasan Securities issues a JP¥ 2.0 billion tokenised bond through Progmat. Mizuho Securities co-underwrote the bond with Okasan Securities, while Mizuho Bank acted as bond manager and MUFG as custodian bank.

December 2023: Residential real estate in Nihonbashi Ningyocho worth JP¥ 5.0 billion is tokenised through Progmat. Mitsui & Co.’s asset management arm acted as operator and distributor.

December 2023: Hitachi issues JP¥ 10.0 billion of “digitally tracked green bonds” using the ibet for Fin blockchain network developed by BOOSTRY as registry. Nomura Securities Co., was the sole underwriter and distributor, Mizuho Bank the administrator and fiscal agent and MUFG the custodian.

2024

January 2024: Student accommodation valued at JP¥ 7.0 billion is tokenised through Progmat. The asset management arm of Mitsubishi Corporation was the operator and Daiwa Securities the distributor.

January 2024: Accommodation at Maihama valued at JP¥ 12.4 billion is tokenised through Progmat. The operator was Kenedix Asset Management, and the distributors were Daiwa Securities and SMBC Nikko Securities.

February 2024: Office space at Nagoya valued at JP¥ 6.96 billion is tokenised through Progmat. The operator was Kenedix Asset Management, and the distributor was Tokai Tokyo Securities.

February 2024: Daiwa Securities issued a JP¥ 1.0 billion one-year bond through Progmat, paying interest in e-money to Rakuten Edy, a digital wallet popular with investors in Japan.

March 2024: Hitachi Construction Machinery Co., Ltd. issued JP¥ 10 billion of five-year Green bonds structured by Daiwa Securities and co-led by Daiwa Securities, Nomura Securities and SMBC Nikko Securities.

The unexpected lesson of the substantial progress of tokenisation initiatives in Japan is that the market is working, not because it is collaborative, but because it is open.

(1) The FATF Recommendations are not compulsory and governments are left to implement them in their own way (and not every government has). See also Mai Ishikawa, “Designing Virtual Currency Regulation in Japan: Lessons from the Mt Gox Case,” Journal of Financial Regulation, Volume 3, issue 1, March 2017.

(2) Arora, Gaurav, “Cryptoasset Regulatory Framework in Japan,” 27 October 2020. Available at SSRN: https://ssrn.com/abstract=3720230 or http://dx.doi.org/10.2139/ssrn.3720230

(3) See “How Stablecoins are being regulated: Japan,” in Future of Finance, Stablecoins: Where They Came From, Where They Are Now and Where They are Going Next, April 2023, page 94.

(4) The JSTA is a supporting member of the JSTOA.

(5) See Future of Finance, “Having built the tools for institutions to embrace tokenisation, Digital Asset is now building the network to make it

happen,” 9 April 2024, at https://futureoffinance.biz/having-built-the-tools-for-institutions-to-embrace-tokenisation-digital-asset-is-nowbuilding-

the-network-to-make-it-happen/

(6) See Future of Finance, “Having built the tools for institutions to embrace tokenisation, Digital Asset is now building the network to make it happen,” 9 April 2024, at https://futureoffinance.biz/having-built-the-tools-for-institutions-to-embrace-tokenisation-digital-asset-is-now-building-the-network-to-make-it-happen/

(7) BOOSTRY Co., Ltd., BOOSTRY Releases Japan Security Token Market Report (FY2023), 2 April 2024.