How will tokenisation transform financial markets?

- Jan 21, 2025

- 12 min read

Updated: Sep 4, 2025

What are the incentives for private debt and equity issuers to tokenise their offerings?

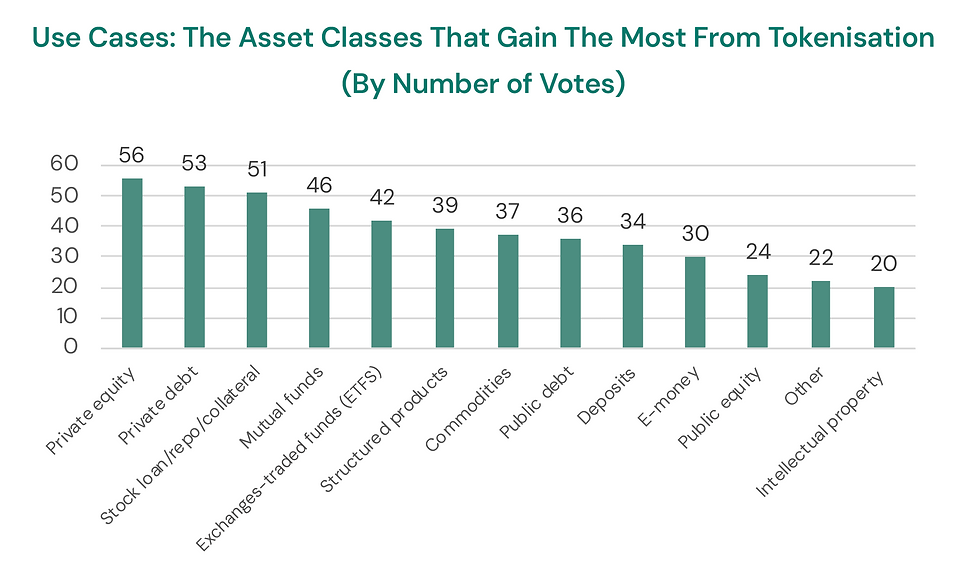

Securities token offerings (STOs) are suited to companies that are too big for crowd-funding platforms and too small for the conventional capital markets. So it is not surprising that the audience thought private debt and equity issuers are not just the obvious beneficiaries of tokenisation (Chart 1) but the issuers with the greatest appetite to tokenise securities (Chart 2) and the issuers with the most to gain from working with regulated digital asset exchanges (Chart 3). Tokenisation has the potential to enable small and medium-sized companies to raise equity or debt capital in the right amounts at a lower price than bank lending. STOs also enable companies to build relationships with investors – including retail investors - that allow them to tap the market in the future, and so retain access to external capital over time. As the companies become better known, and their securities increase in value and volume, and other companies come to the market, liquidity will develop. Eventually, the price of capital for individual companies will be set not by bank credit officers but in the secondary market for their security tokens. It would accelerate the emergence of liquidity if the ratings agencies assessed tokenised debt issues traded on digital asset exchanges.

Chart 1

Why would private debt and equity issuers choose an STO over a private placement?

An STO is not the token equivalent of an Initial Public Offering (IPO). The initial costs of an STO have the potential to be lower than the 5-10 per cent of money raised in a typical IPO. (1) Capital can also be raised in smaller amounts than the c. US$100 million minimum of an IPO. Companies can list part of their issued equity capital on a digital asset exchange, which enables existing holders to exit a share of their investment without losing control. Investment banks organising IPOs focus on placing stock with institutional investors, while STOs provide access mainly to retail investors, but without excluding institutional investors. Indeed, STOs can be structured specifically to attract qualified institutional investors. Above all, a listing of tokens introduces an issuer to a larger universe of potential investors that can then access the stock in the secondary market. In Switzerland alone, more than 200 companies have tokenised their equity without it becoming tradeable. Listing on an exchange makes secondary market trading possible.

What is the incentive for digital asset exchanges to support the tokenisation of private equity and debt?

They are large markets. The 2024 McKinsey Global Private Markets Review values private equity outstandings at US$7.95 trillion and private debt at US$1.7 trillion, and McKinsey is not monitoring the entire markets. Private equity and debt also have no infrastructure for issuance, trading, settlement and custody, so digital asset exchanges can provide it. Such an infrastructure offers issuers and investors immediate gains in operational efficiency, and long-term benefits in terms of liquidity.

Why is there an opportunity to tokenise structured products?

Structured products - financial instruments issued by banks with varying terms, payoffs and risk profiles tracking the performance of an underlying asset such as an equity, index, commodity or currency - are short-dated securities that are listed on traditional stock exchanges. They command a massive retail following throughout Europe, and especially German-speaking Europe. The European market hosts 1.5 to 2 million new issuances per quarter (2), so the market is large. Yet structured products also suffer from conspicuous inefficiencies at issue and in the subsequent servicing of the contracts. In Germany, the digital issuance of structured products into a central securities depository (CSD) is proving cheaper and faster than traditional methods of issuance already. However, present solutions impose CSD fees on issuers and leave the post-issuance settlement of the payoffs by the CSD untouched. The audience certainly believes that there is demand from structured product issuers for the efficiencies tokenisation can offer (see Chart 2) and that digital asset exchanges can deliver those efficiencies (see Chart 3). BX Digital reckons it can cut structured product issuance and servicing costs by eliminating the CSD, which in Germany typically charges banks issuing structured products €5-6 per issuance. The reason Börse Struttgart Group can eliminate the CSD - despite the obligation under Article 3 of the Central Securities Depositories Regulation (CSDR) of the European Union (EU) that securities tradeable on an exchange must be issued into a CSD - lies in the nature of the new regulatory licenses available for DLT.

Chart 2

How important are retail investors to the success of tokenised assets and how easy are they to access?

The possession of DLT and TSS licences means retail investors will have the assurance of interacting with regulated institutions. The availability of assets in tokenised form on digital asset exchanges means retail investors will also be able to trade tokens around the clock instead of within fixed trading hours only. Yet the intermediation of retail distribution by banks, private banks and wealth managers is unlikely to change quickly, even though the issuance, trading and settlement of tokens on public blockchains is an obvious opportunity to distribute products directly to retail investors. A study by the European Securities and Markets Authority (ESMA) found that 89 per cent of asset management product distribution in Europe is business-to-business-to-consumer (B2B2C), so most asset managers are not distributing their products directly. B2B2C does mean intermediaries – fund platforms, transfer agents and fund accountants as well as fund distributors - must be persuaded of the case for tokenisation, which is likely to retard progress towards fully tokenised markets. However, since the DLT and TSS licences mean asset management products can be distributed to investors directly in a regulatorily compliant way, including via public blockchains, there is no reason in principle why direct distribution should not grow. Tokenised money market funds are an obvious low risk starting point for direct retail distribution. They would encourage retail investors to acquire digital wallets, which they can then use to purchase and hold other tokenised assets. BUX, the neo-broker acquired by ABN Amro in December 2023, has identified retail demand to hold tokenised versions of popular stocks such as Tesla and Microstrategy. This suggests there is scope for asset managers to develop risk-weighted portfolios of tokenised assets for sale to retail investors.

Are tokens especially attractive to retail investors?

Tokenisation cannot in and of itself drive retail demand. The retail investor, like any other investor, is interested not in investment vehicles but investment returns. And returns are still governed by the economics of the underlying investments. The performance of tokenised real estate, for example, is determined by the same market factors as a conventional real estate investment. Those factors include a predictable income stream from rents but also imply an intrinsic illiquidity because buildings are hard to sell quickly. Real estate funds mitigate that liquidity risk by acquiring a portfolio of assets. Tokenising a fund does not improve on that risk management strategy. Nor can tokenisation conjure liquidity out of other intrinsically illiquid assets, such as private equity investments. What tokenisation does offer is access to retail investors by issuers and affordable and transparent access to previously inaccessible asset classes for retail investors.

How will regulators react to direct distribution of tokenised assets to retail investors?

Direct retail distribution of tokens does pose challenges for regulators, whose principal responsibility is investor protection. A recent report by the Financial Conduct Authority (FCA) in the United Kingdom found that most investors in cryptocurrencies conducted no research at all into the cryptocurrencies they buy. Cryptocurrencies lie outside the regulatory perimeter, but there is a risk that the habit extends to asset classes that lie within the scope of regulation. If retail investors apply similarly minimal levels of research into, say, programmable private equity fund tokens traded algorithmically, regulators might struggle to fulfil their duty to protect investors without imposing further restrictions on product distribution. At present, regulators are reliant on increased disclosure. Tokenised ETFs, for example, must comply with the Packaged Retail and Insurance-based Investment Products (PRIIPs) Regulation of the EU, which obliges issuers to share key information documents (KIDs) with investors prior to completion of an investment. Issuers are also publishing prospectuses that itemise the risks associated with particular token investments, and digital asset exchanges are distributing these, and publishing information of their own about the risks associated with tokenised assets.

How can digital asset exchanges encourage the tokenisation of ETFs?

In one sense, the answer is obvious. ETFs are, as the name suggests, traded on exchanges already. At BX Swiss, for example, ETFs have increased from a tenth of total trading volume in 2023 to a third in 2024. This is consistent with the growing popularity of ETFs generally, especially among retail investors. Retail investors are now more likely to purchase ETFs to acquire equity exposure than cash equities, and exchanges can help ETF issuers reach retail investors. So it is not surprising that the audience ranks ETFs behind only tokenised private equity and debt and structured products as an asset class where they see both demand for tokenisation (Chart 2) and exchanges playing an important role (see Chart 3).

Chart 3

What can exchanges do to encourage the tokenisation of mutual funds?

The audience sees mutual funds as a major beneficiary of tokenisation (see Chart 1) but is less persuaded of the scale of demand to tokenise mutual funds (see Chart 2) and even less that exchanges have a major role to play in tokenising mutual fund markets (see Chart 3). This is an astute set of observations. In terms of operational efficiency, mutual funds have much to gain from replacing the fragmented and highly intermediated distribution, registration and accounting eco-system that prevails today. Yet obtaining those benefits requires substantial investment in technology, connectivity and processes now. To avoid incurring that cost, asset managers, transfer agents, fund accountants and fund platforms have pursued instead a “digital twin” model of mutual fund tokenisation in which funds continue to exist in the original form and few operational cost savings are achieved at all. Since mutual funds are currently not traded on-exchange but issued and redeemed by asset managers as principals, the prospect of exchanges hosting active secondary markets in tokenised funds is equally distant. The one encouraging area for exchanges in the mutual fund markets is the growing appetite for tokenised money market funds. Asset managers as issuers are meeting demand for money market funds from active participants in the cryptocurrency markets seeking an alternative to Stablecoins. With interest rates elevated, tokenised money market funds offer a more remunerative home for cash awaiting investment than non-yielding Stablecoins. They can also be used on-chain to collateralise liabilities and even make payments. In other words, tokenised money market funds already justify the costs of adaptation to tokenised markets, so asset managers are making the investment. The task for exchanges is to identify comparable use-cases in other parts of the mutual fund market. ETFs are already proving the value of exchanges in providing primary and secondary markets for tokenised funds. Though it will take time for mutual funds to be issued and traded on-exchange, the similarities between actively traded ETFs and actively traded mutual funds are a suggestive avenue of convergence. Unlike ETFs, which rank as transferable securities traded on-exchange, tokenised mutual funds also have the advantage that they do not need to be issued into a CSD under article 3 of CSDR. However, that advantage will decay over time as exchanges in Europe obtain TSS licences.

How important to token markets is the availability of fiat currency on-chain?

The main reason behind the rising interest in tokenised money market funds is the continuing absence of fiat currency on-chain. Indeed, tokenised money market funds may prove to be no more than a short-term expedient pending the introduction by banks of tokenised deposits and by central banks of central bank digital currencies (CBDCs). These are not developments exchanges can do much to encourage. Indeed, although the audience believe tokenised deposits would be useful (see Chart 1) they see little demand for them yet (see Chart 2) and cannot envisage a role for exchanges in listing, settling or safekeeping them (see Chart 3). But the importance the audience attaches to “e-money” (see Chart 2 especially) reflects the obvious value of on-chain money, even if the audience do not expect central or commercial bank money on-chain soon. CBDCs are the ideal form of on-chain money and would certainly generate more interest in token markets from banks and other regulated financial institutions, so token market participants should do more to encourage central banks to accelerate the issuance of CBDCs. The trials being conducted by the European Central Bank (ECB) are widely admired, partly because they reflect an understanding that regulated financial institutions will limit the growth of token markets until they have the equivalent of fiat currency on-chain. By engaging the banks, the ECB trials have generated conspicuous momentum and raised expectations of early issuance of a euro CBDC. The trials have already proved delivery versus payment in central bank money for primary market issuance, secondary market trades, coupon payments and intra-day repos, with margin calls, swaps and cross-currency settlement to follow. However, a CBDC even in euro is still a minimum of two or three years in the future. In the meantime, BX Swiss is straddling the digital and conventional markets by experimenting with smart contracts to settle transactions bi-laterally in Swiss francs and euro. The smart contracts use technical bridges that connect the Ethereum blockchain used by BX Digital with Swiss Interbank Clearing (SIC), the payment system of the Swiss National Bank. The sister company of BX Digtial that has applied for a TSS licence will use smart contracts in a simular way to settle transactions in TARGET2, the payment system of the ECB. This enables banks to take part in on-chain payments processes ahead of CBDCs becoming available.

What role can exchanges play in tokenised securities financing transactions?

The audience identifies the securities financing markets – stock loan, repo, collateral management – as an early beneficiary of tokenisation (see Chart 1) but is less convinced of the demand for it (see Chart 2) or that exchanges can play a role in making it happen (see Chart 3). This is a sensible assessment. Securities financing is manifestly a tokenisation use-case. There is a demonstrable need to mobilise collateral, the savings for banks on cash, collateral and capital are measurable, the programmability of tokens makes intra-day transactions possible, and several initiatives are live, at least one of which is making money already. But, in addition to the various token initiatives already in train, securities financing trades have long been the preserve of specialist dealer-to-dealer OTC platforms. True, as part of the re-regulation of financial markets in the wake of the financial crisis of 2007-08, international regulators have encouraged their national counterparts to shift OTC trading of financial products on to regulated electronic trading venues. As a result, OTC platforms are seeking authorisation as Multilateral Trading Facilities (MTFs). Although securities financing trades are therefore moving on-exchange as MTFs, it would be challenging to get securities financing market participants to engage with blockchain infrastructures at the same time as they are shifting activity away from OTC platforms. It makes better sense to establish successful blockchain networks first, and then look to move securities financing activity on to them.

Why are digital asset exchanges ignoring the public debt and equity markets?

One answer is that they are not. Exchanges understand the public debt markets can obtain significant efficiencies from tokenisation in the simultaneous sharing of documentation in the issuance process, programmability in asset servicing such as daily or intra-day coupon payments, and more precisely timed or conditional settlement. Several token initiatives are already addressing these opportunities. They encounter resistance from incumbent intermediaries that fear disintermediation. They also struggle to persuade asset managers and end-investors to invest time and money in understanding and connecting to tokenised debt markets, because the initial gains in efficiency are not significant enough to warrant the investment. Likewise, the audience sees the efficiency opportunity for tokenisation in the public debt markets (see Chart 1) but does not yet see the level of demand (see Chart 2) that would persuade exchanges to invest (see Chart 3). The implication is that the public equity markets are efficient enough not to be an early use-case for tokenisation (see Chart 1). In fact, it is wrong to assume the public capital markets are too efficient to benefit from tokenisation. The difficulty is that the status quo is not inefficient enough, nor the gains quantifiable enough, to trigger a wholesale transition to tokenised marketplaces. If tokenisation could enhance liquidity, especially in the highly illiquid buy-and-hold corporate debt markets, that calculation could change. But tokenisation cannot generate liquidity unaided. By making illiquid asset classes accessible by retail investors, it can lower the cost of capital for issuers and increase the likelihood that liquid markets in tokenised assets will develop, but not generate liquidity spontaneously. Ultimately, liquidity depends on European capital markets overcoming the fragmentation created by purely national market infrastructures, company and securities laws, regulatory regimes and tax systems. Critics frequently accuse blockchain-based markets of lacking interoperability, but the same is true of traditional capital markets. Indeed, in technical terms, blockchain markets are making faster progress towards interoperability than the traditional markets, where different asset classes are trapped in infrastructural, legal and regulatory siloes within jurisdictions as well as between them. It follows that the best accelerator of public debt and equity market liquidity in Europe would be the creation by political reforms of a single capital market comparable in size and scope to that of the United States. The Capital Markets Union (CMU) programme of the EU aims to achieve this but faces formidable obstacles. Since such ambitious reforms are beyond the capacity of market participants to accomplish, it makes sense for them to focus instead on use-cases where tokenisation delivers measurable value. The audience certainly believes this, indicating repeatedly in the poll (see Chart 2) that exchanges should focus primarily on meeting demand from private equity, private debt, structured products and ETF issuers. Indeed, they place intellectual property (IP) and commodities ahead of public debt and equity as opportunities for digital asset exchanges (see Chart 3).

What else can exchanges do to help tokenisation happen?

Growth in tokenised asset markets depends on digital asset exchanges resisting the temptation to monopolise any of the services they provide: issuance, registration, trading, distribution, settlement or custody. Exchanges must remain open to become part of an eco-system, or community of shared interests, that grows organically. If banks, for example, can conduct business more efficiently via a digital exchange, they will share those benefits with retail and institutional investors. The benefits need to be openly accessible, and the costs transparent, so all market participants have the incentive to take part. This is why BX Digital is built already on Ethereum, is planning to be available on Polygon, and is open to other blockchain protocols as well, embraces multiple solutions to moving cash on- and off-chain and settling the cash leg of transactions, and supports a wide variety of interoperability tools. Traditional exchanges need to embrace this openness as well and introduce their members to tokenised assets, enabling them to become steadily more active in digital as well as conventional assets. This will educate established market participants about blockchain, making plain to them the differences between tokenised assets and cryptocurrencies, while reassuring investors that they can buy tokens without stepping outside the regulatory perimeter.

Tokenisation Transforming Financial Markets